- Eastwest Savings Account

- How To Apply Eastwest Savings Account

- Eastwest Savings Account Atm Requirements

- Eastwest Savings Account With Passbook Requirements

- Eastwest Savings Account With Passbook

- How To Apply Eastwest Basic Savings Account

Eastwest bank basic savings account requirements Valid ID 1×1 or 2×2 picture Proof of billing. EastWest Mobile is a banking app designed for customers enrolled in EastWest Online Banking, so they can conveniently access their accounts - whether Savings, Checking, or Credit Cards - on mobile devices. Check your balance Conveniently check your account.

East West Bank Premier Savings Account is offered by East West Bank, a bank founded in 1973 and based in Pasadena, CA. East West Bank Premier Savings Account is available in 7 states across the USA.

[Last updated 19 May 2020] EastWest Bank (Philippines, PSE: EW), also East West Banking Corporation, is the 10th largest universal bank (in assets) in the Philippines. It operates as a subsidiary of Filinvest Development Corporation (PSE: FDC), one of the country’s leading conglomerates with interests in real estate development, hospitality and tourism, and banking.

With aggressive expansion efforts in the recent years, EastWest Bank has sustained its strong growth momentum and emerged as one of the country’s leading and most trusted partners of Filipino depositors and investors. In 2011, EastWest Bank renewed its brand of excellent client-centered services through a tag line “Your Dream, Our Focus” (source: EastWest Bank official website).

EastWest Bank Deposit Products (Savings)

[1] Basic Savings (Initial Deposit: PHP 100.00) is the most affordable interest-earning savings account with an incredibly low initial deposit and maintaining balance requirement offered by EastWest Bank. It comes with a debit card that can be used for over-the-counter transactions at any EastWest Bank servicing branch, ATM withdrawals, EastWest Bank online facility, and Visa-accredited merchants worldwide.

[2] Kiddie Savings (Initial Deposit: PHP 2,000.00) is another interest-earning peso-savings deposit account exclusive for children who enjoy early financial management training. It comes with a passbook, and allows over-the-counter transactions and a fund access via EastWest Bank online facility.

[3] Passbook Savings Account (Initial Deposit: PHP 5,000.00) can be an ideal account type for conservative depositors who keep track of daily transactions with a history record on hand. It allows deposits and withdrawals anytime at any EastWest Bank servicing branch and a fund access via EastWest Bank online facility.

[4] Passbook Savings with Debit Card (Initial Deposit: PHP 10,000.00) comes with a traditional passbook and a Visa debit card that can be used to secure documented transactions while enjoying the benefits and convenience of modern-day banking system.

[5] Regular Savings with Debit Card (Initial Deposit: PHP 2,000.00) is an interest-earning savings account that comes with a debit card and can be used to make over-the-counter transactions, local ATMs and Visa Plus ATMS worldwide withdrawals, and online and offline purchases with EastWest Online Visa-accredited and Visa-accepting online merchants.

[6] Super Saver (Initial Deposit: PHP 500,000.00) is a high-end EastWest Bank savings account that comes with a tiered interest rates, hence pays interest in increasingly higher amounts as the account balance increases.

*All EastWest Bank deposit products earn interests at varying rates. You can visit the nearest servicing branch to make inquiries about other deposit products and existing interest rates.

EastWest Bank Account Opening Requirements

Here are the minimum documentary requirements upon opening a savings account with EastWest Bank (requirements may vary depending on deposit accounts and selected servicing branches):

- 2 pieces 1×1 (or 2×2) latest ID pictures

- Tax Identification Number (TIN and other information, for completing forms)

- Original and clear copy of at least one (1) valid photo-bearing identification document issued by an official authority (or better bring all available IDs)

- Required initial deposit

- Proof of Billing

EastWest Bank Account Opening Procedure (5 Easy Steps)

Opening savings and other deposit accounts, along with requirements, can be almost the same across all banks in the Philippines. As what I have experienced with major commercial and universal banks, the usual process comes with a few forms, ID cards and other requirements, and verifiable personal details.

[1] Get Entertained at the New Account Section. As soon as you reach the bank, tell the welcoming guard that you wish to open a savings account. Your transaction will be accommodated at the New Account Section. Your attending bank clerk will brief you about available deposit products (or applicable savings accounts) and the bank rules and regulations in handling deposit accounts.

[2] Fill Out Account Opening Forms. After deciding on a deposit product, you will be asked to accomplish a few forms required upon opening a new bank account. Fill them out with accurate details and try to write legibly. At any EastWest Bank branch, the following are the required forms:

- Customer Record Form

- Signature Cards

- Application for ATM Card/Debit Card (if applicable)

- Authorization to Debit (if initial deposit in debited to another account)

- Deposit Slip (for initial deposit required)

[3] Present Your Documentary Requirements. Hand over your prepared account opening requirements to the bank clerk (Check EastWest Bank Account Opening Requirements listed above). Please don’t forget to double-check if the presented IDs are returned to you before leaving the bank to avoid any hassle.

[4] Make Your Initial Deposit and Claim Your Passbook (if applicable). After completing all forms and submitting your requirements, you will be asked to shell out for the required initial deposit. (Check EastWest Bank Deposit Products detailed above). EastWest Bank Passbook Savings with Debit Card, for example, requires an initial deposit of PHP 10,000.00. In most branches, passbooks can be claimed right away after making a deposit.

[5] Come Back After a Week for Your ATM Card/Debit Card (if applicable). If you opted for an account with an ATM/Debit card, you will be advised to come back after a week to claim it. Don’t forget to ask for branch contacts so you could call them first before attempting to claim it. Upon claiming your ATM/Debit card, do the PIN Change right away with the bank machine. Take note that EastWest Bank branches are not as many as those of other commercial and universal banks.

Other Related Articles:

Disclaimer: The author is not directly affiliated with East West Banking Corporation (Philippines) Please take this article as a simple tutorial on how to open a deposit account with EastWest Bank and not a help page for your other concerns and issues with the bank.

Eastwest Savings Account

I applied for their Project 8-Shorthorn Eastwest Branch in our area and was assisted by Ms. Aivee and Ms. Jill. They are very kind and answers questions about the account I am interested to open. I bought two secondary IDs, a barangay clearance to certify my residence address and the latest Meralco bill with the same address on my IDs. It took me 30 minutes to fill up and submit my application and paid 100php for initial deposit and maintenance. They gave me the deposit slip with my account number and was advised to pick up my atm/debit card exactly 7 days after my application.

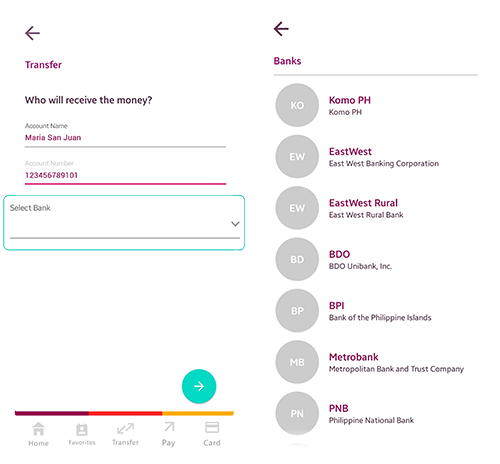

A week later, I picked up my new Eastwest ATM/debit card. I waited 24 hours since they told me to wait for they will activate my card within 24 hours. Unlike other leading banks, Eastwest doesn't have a mobile app but they do have an internet banking. I enrolled my EastWest Visa Debit Card at eastwestbanker.com so I can check anytime my banking transactions. You can transfer your funds to other Eastwest accounts as well as interbank (Fund transfer to other BancNet Member Bank using EWB VDC) and pay bills using internet banking.

Since it is also a Visa bearing card, you may verify your PayPal account using it but my PayPal is already verified using Payoneer and Skrill Prepaid Mastercard so I just try to withdraw my funds to my new savings account. When I added my new Eastwest Basic Savings account to PayPal, it is considered as a checking account so I already got an idea that this is not a usual or regular savings account.

I withdraw around 7am last January 13 from PayPal to check how long it will take for my funds to reflect on my Eastwest account. It was already 8pm the same day and my funds from Paypal is already credited to my account without charging me 200php as remittance fee, unlike other banks. The only one charged to me was PayPal's 50php fee for withdrawing funds below 5,000php.

Requirements:

- (2) Valid IDs

- TIN ID (Depends on Branch you are applying)

- Latest Bill with the same address of your IDs

- 100 Php for the initial deposit

How To Apply Eastwest Savings Account

Pros:

Eastwest Savings Account Atm Requirements

- Easy to apply.

- Low maintenance fee and you can earn interest while saving money

- Shop online or use to pay on merchants who accept Visa Card for payment

- Can verify your Paypal account.

- Withdraw funds from your Paypal account fast with no fees.

Eastwest Savings Account With Passbook Requirements

Cons:Eastwest Savings Account With Passbook

- Eastwest Bank does not have a mobile app yet.

- Hassle to use on verifying your Paypal account.

- There are instances that 4 Digit code generated by Paypal doesn't show in your transaction history.