Marcus by Goldman Sachs offers savings accounts and CDs at high interest rates. But don't expect accounts with a lot of bells and whistles. Read on for the pros and cons.

Marcus by Goldman Sachs offers one of the highest APYs for a 12-month CD. While you can find slightly higher yields from other banks, Marcus by Goldman Sachs’ rates are very competitive. Website: Authority: Marcus by Goldman Sachs, is a online retail bank named after its founder Marcus Goldman. As of the end of 2017, Marcus was serving more than 350,000 customers. Goldman Sachs is a leading global investment bank based in New York City. How to open a Marcus by Goldman Sachs Certificate of Deposit.

- As you can see below, it's generally on par with rates from Capital One, Ally Bank and Marcus by Goldman Sachs. However, Capital One is clearly weaker than its competitors when it comes to one- and three-year terms, whereas Barclays currently has the worst rate for the five-year category.

- Marcus by Goldman Sachs allows for the penalty-free withdrawal of interest earned on your CD each month. You can either transfer the interest to a Marcus Online Savings Account or an external bank.

Marcus (previously GS Bank) is the online bank offered by the investment giant, Goldman Sachs. It offers savings products with very competitive rates and no minimum deposit and no services fees.

But there are no branches, no checking, and no ATM network. All banking is done online or over the phone.

Read on to see if it's right for you.

- Services Offered

- Online Savings Account

- CDs

- Personal Loans

- Pros

- Cons

Services Offered

Marcus by Goldman Sachs only offers savings products and personal loans. Here's a quick overview:

- Online Savings Account: Earn competitive interest rates with as little as just $1 deposit. This is like a typical savings account, except that there are no physical branches or an ATM network.

- High-Yield and No-Penalty CDs: CDs have $500 minimum opening deposit. You lock in a rate, so you know exactly how much interest you will earn. You can earn a higher APY if you can commit to tying up your money for longer.

- Personal Loans: Get a fixed-rate personal loan up to $40,000. Goldman Sachs charges no origination fee, no prepayment penalty, no late fees.

Marcus Online Savings Account

The online savings account offers a very high rate, though you'll have to sacrifice some conveniences. Here are some details:

Marcus Online Savings - Earn 0.50% APY

No minimum deposit

- Minimum of $1 to earn the stated APY

- No minimum opening deposit requirement

- No monthly service fees

- No transaction or transfer fees

- Daily compounding interest

- FDIC insured

Like all savings accounts, federal regulation limits you to 6 withdrawals and/or transfers per month.

There is no mobile check deposit feature or ATM card. You'll need to transfer money in and out of an external account. So there may be some delay when transferring funds.

Compare Savings Account Promotion

Online Savings Account - Earn 0.40% APY

- No fees

- No minimum opening deposit

- No minimum balance required

Certificate of Deposits

Marcus by Goldman Sachs offers two types of CDs:

- High-Yield CDs (Terms of 6 months to 6 years):

The minimum to open is $500. But you have 30 days to fully fund your CD. You can continue to add funds into it for 30 days after account opening.Your rate is locked in for the entire term. If you can commit to not touching your money for a year, the 12-month CD offers one of the best rates on the market. Longer terms offer higher APYs.

High-yield CDs come with a 10-day rate guarantee. If the rate on your selected CD goes up within the first 10 days, you'll automatically get the higher rate.

What is the penalty for early withdrawals from Marcus CDs?

It depends on the term of your CD. Here's how it breaks down:- Terms up to 1 year: 90 days of interest on the principal

- Terms from 1-5 years: 270 days of interest on the principal

- Terms over 5 years: 365 days of interest on the principal

12-month High-Yield CD - Earn 0.55%

$500 Minimum Balance

- Terms up to 1 year: 90 days of interest on the principal

- No Penalty CD (one fixed term of 13 months):

This CD gives you the flexibility to withdraw your full balance with no penalty (starting from 7 days after account funding). This is good if you suddenly need your money. The minimum to open is $500 (you cannot add more funds).The rate on this CD is actually a little bit better than the online savings rate. And the ability to withdraw gives you some peace of mind that your money isn't tied up.

13-month No-Penalty CD - Earn 0.25%

No early withdrawal penalty

Your CDs have a 10-day grace period after maturity. Once your CD matures, you have 10 days to either withdraw the funds, renew the CD, or close it and open a new CD with a different term.

You can also have your CD's interest disbursed to an external account. You just have to call customer service to arrange it.

Tip: CD laddering is a smart savings strategy. This is when you split your investments into different CDs with staggered maturity dates. As each CD matures, you can re-invest the money into a new CD with the new current rate.This way you can get higher interest rates on longer-term CDs without tying up all of your money for a long time. Read more about CD laddering from Marcus.

Personal Loans

Marcus also offers personal loans that can be used for anything from debt consolidation to home improvement. Here are some details:

- Personal loans from $3,500 to $40,000

- Fixed interest rate for the entire life of the loan

- Fixed monthly payments

- No fees ever. No origination fee, no prepayment penalty, no closing fees, and no late fees (you only pay interest for the additional days).

You can first see your loan options in just a matter of minutes, without affecting your credit score. If you don't like your options, you don't have to go through the official application process.

Why We Like Marcus by Goldman Sachs

- High interest rates. Interest rates are competitive with other online savings and CDs, and as much as 25x more than traditional brick-and-mortar banks.

- Low opening deposits. There is no opening deposit for the Online Savings Account, and only $500 for CDs.

- No fees. There are no monthly service fees, no transaction fees, and no transfer fees.

- FDIC insured. If the bank goes out of business or runs out of money, the FDIC will reimburse you up to $250,000.

- Extended customer service hours. You can reach representatives via phone from 8 AM to 10 PM Monday - Friday and 9 AM to 7 PM Saturday - Sunday.

- Interest calculators. Marcus provides calculators to estimate of the amount of interest you'll earn. This could be the motivating factor you need to start putting money away.

- Up to 6 beneficiaries. You can name up to 6 pay-on-death beneficiaries per account.

Downsides

In exchange for high rates, Marcus does away with a lot of features.

- No mobile deposits. If you want to make a deposit, you'll have to do so the old-fashioned way - via the mail. You can also deposit the money into an external account and then make a transfer online. Either way, it's extra steps.

- No checking accounts. If you like to keep all of your accounts in one place, this could be a downside.

- No ATM card or ATM network. There is no way to get fast access to your funds.

- No physical branches. All business must be done online or over the phone.

- No mobile app. However, you can sign in to your account on your mobile phone and bank from there. Just less convenient than banking via app.

- Chase coupon for National Bank

- Discover Bank offer code

- CIT Bank promo code (bank review)

How It Compares

- Ally: Ally offers a larger variety of accounts than Goldman Sachs, including a checking account. Their accounts have no monthly fees and you don't need a minimum deposit for the checking or CD accounts. Ally also has a network of fee-free ATMs for you to access your funds.

Ally is often a customer's favorite for their superior service and user-friendly interface and mobile app. Their customer service is available 24/7.

- Capital One: Capital One 360 offers checking, online savings, and CDs. The rates are lower than what Marcus by Goldman Sachs offers, but could be a good choice if you want all your banking in one place. We like Capital One 360's options for teen checking and kids savings.

There are no monthly service fees. But they do charge steep overdraft protection fees if you opt into that service.

Bottom Line

Marcus by Goldman Sachs isn't meant to replace all your banking needs. It's good as a bare-bones savings account with high rates. You can park your money there and have it grow securely.

Your best returns will be achieved with longer deposits and higher balances. When you combine that with the limited fees, it can be a winning combination for you.

Just understand that there are no convenience features, like mobile deposits, ATM network, or mobile app.

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next:

|

|

|

Disclaimer: This post contains references to products from one or more of our advertisers. We may receive compensation (at no cost to you) when you click on links to those products. Read our Disclaimer Policy for more information.

Sometimes it pays to put your money in a bank with a sterling reputation and high-interest rates for its savings accounts.

If you want to store your money in a secure bank and watch it grow over time, you might be interested in signing up for a Marcus by Goldman Sachs account.

Let’s break down everything you need to know about this bank so you can decide if it’s right for you.

Marcus Goldman Sachs Cd Accounts

Marcus by Goldman Sachs Overview

What is Marcus by Goldman Sachs?

Marcus by Goldman Sachs is a direct online banking institution that offers a handful of account options and financial products.

It’s noteworthy in part due to the high-interest rates across all of its products and its relatively low fees and account balance requirements.

Essentially, you can store your money for practically nothing and get an excellent return via interest rates over time.

These are just a few reasons why millions of Americans turn to Marcus for their banking needs.

What Does Marcus by Goldman Sachs Offer?

Marcus’ primary offerings are a pair of savings account options: a regular online savings account and the option to transition to a CD or certificate of deposit.

A CD is a specialized type of savings account that allows you to store your money for a set period of time.

You cannot withdraw your money from a CD until an agreed-upon date. In exchange, your savings in the CD benefit from higher-than-average interest rates.

Marcus Featured Products

Marcus by Goldman Sachs Online Savings Account

- Account Minimum: $0

- APY: 0.50%

Marcus’ online savings account is a simple financial tool that charges no extra fees and has a relatively high APY or annual percentage yield.

Note that Marcus requires no minimum deposit, either. It does require $1 to open the account, but after that, you can leave your balance at $0 with no penalty.

Learn More: Best High Yield Savings Accounts

Marcus by Goldman Sachs No-Penalty CD

- APY: 0.45% for 7-month term, 0.35% for 11-month term, 0.25% for 13-month term

- Minimum deposit: $500

- Term: 7-11 months

Marcus offers two types of CDs. The No-Penalty CD is perfect if you like to keep your options open, as it doesn’t come with the usual limitation of preventing you from withdrawing your funds from the CD if you need fast cash in a pinch.

Marcus Bank Goldman Sachs

There are no early withdrawal penalties for doing this. But the CD rates are lower than the interest rates for the other CD offered (see below).

Marcus High-Yield CD Rates

This is the other CD option offered by Marcus by Goldman Sachs. It has the same $500 account minimum to open, but you’ll enjoy significantly higher interest rates if you agree to longer terms.

You can use this to significantly grow a lump sum for several years before the withdrawal.

This account does charge an early withdrawal penalty if you try to withdraw the funds before maturity. Penalties are between 90 days and 365 days’ worth of interest, depending on your initial term length.

Additional Financial Products Offered by Marcus

- Investment Account(s): Marcus does not offer any investment accounts at this time, unfortunately.

- Personal Loans: Marcus also offers some personal loans to help you pay for high-priced items or cover medical bills when necessary. MarcusPay loans allow you to make big purchases on the go in the form of taking out an instant loan, paying back Marcus over time.

Marcus by Goldman Sachs Bank Review: Fees, Customer Support, & Experience

Banking Experience

Marcus by Goldman Sachs is a limited financial institution overall since it only provides a few account options or products.

Still, these products usually feature great interest rates relative to other banks, and your banking experience is likely to be high-quality.

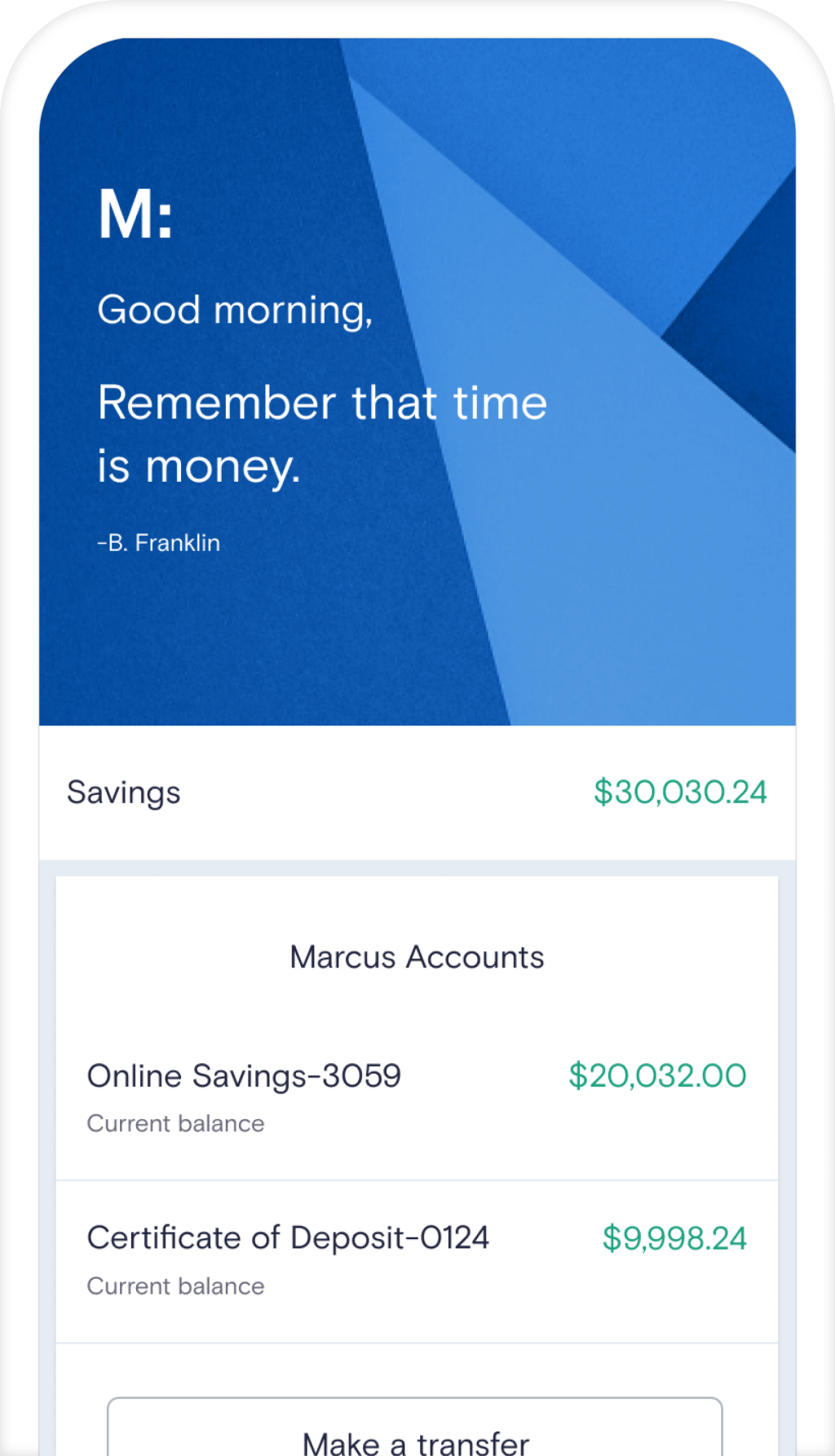

Employees are knowledgeable and supportive, and you can download a dedicated mobile app, which includes money tracking and financial planning tools for your convenience.

The biggest downside is that you must electronically transfer funds into your accounts or use your employer’s automatic deposit feature – a big flaw since Marcus doesn’t have any in-person branches or ATMs to visit.

Customer Support

Marcus’ customer service is pretty great compared to other financial institutions. It offers customer service by phone Monday through Friday from 8 AM to 10 PM with reduced weekend hours.

But you’ll also benefit from a dedicated savings account, personal loan, and MarcusPay customer service lines. Top sports betting companies in us.

This way, you can be connected to someone who can help you with your specific issue quickly instead of having to be routed through multiple customer service reps.

Marcus By Goldman Sachs Fees

Marcus has very few fees scattered throughout its offerings. Its regular High-Interest CD account option does charge you a fee if you make an early withdrawal.

But otherwise, this is a great banking institution since it charges no fees for starting or maintaining an account or for taking out a personal loan.

Marcus Bank Pros and Cons

Pros:

- The mobile app is easy to use and comes with extra tools/educational resources

- Good customer service and dedicated phone lines

- Savings accounts and CDs have good interest rates

- Personal loan terms are good if you have high credit

Cons:

- No ATMs or physical locations to visit

- No business loans – generally limited account types

Marcus by Goldman Sachs FAQs

Is Marcus by Goldman Sachs Legitimate?

Yes. It’s one of the most well-known banking institutions in the industry and has been in operation for well over 150 years!

Is Marcus by Goldman Sachs FDIC Insured?

Yes. All of your deposits up to $250,000 are insured in case of theft or insider fraud.

Is Marcus Safe?

Absolutely. As a primarily online institution, Marcus’ website and mobile app use top-tier digital security, including SSL certification, to provide encryption for its staff and customers.

Bottom Line: Marcus by Goldman Sachs Bank Review

All in all, Marcus by Goldman Sachs is a fantastic place to keep your money if you want your savings to grow over time or if you want to target a particular savings amount through a flexible or high-interest CD.

However, you may want to look elsewhere if you want a more personalized banking experience or if you need access to other account types or loans, such as checking accounts and business loans.

Keep Reading: